Gold Price History in Nepal: Last 10 Years Chart & Analysis

📌 Overview

Gold has always been a culturally significant and economically strategic asset in Nepal. Over the past decade, gold prices in Nepal have seen unprecedented growth, influenced by global market trends, currency fluctuations, import duties, and geopolitical factors. This report presents a comprehensive analysis of gold price history in Nepal from 2015 to 2025, highlighting key economic drivers and implications.

Also Check : Gold Price in Nepal Today (Live Update)

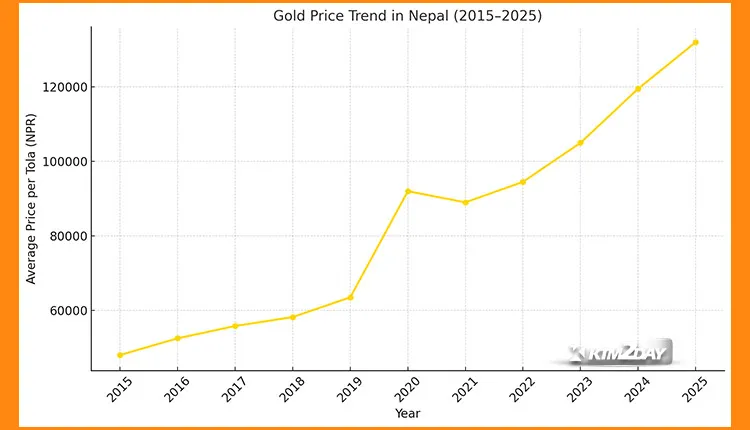

📈 Gold Price Trend Chart (2015–2025)

| Year | Average Gold Price (per tola) | Yearly Change (%) |

|---|---|---|

| 2015 | NPR 48,000 | – |

| 2016 | NPR 52,500 | +9.4% |

| 2017 | NPR 55,800 | +6.3% |

| 2018 | NPR 58,200 | +4.3% |

| 2019 | NPR 63,500 | +9.1% |

| 2020 | NPR 92,000 | +44.8% |

| 2021 | NPR 89,000 | -3.2% |

| 2022 | NPR 94,500 | +6.2% |

| 2023 | NPR 105,000 | +11.1% |

| 2024 | NPR 119,500 | +13.8% |

| 2025* | NPR 132,000 (est. mid-year) | +10.5% (YTD) |

*Note: 2025 value is based on mid-year estimates and subject to change.

🔍 Key Drivers of Gold Price Movements

1. 🌐 Global Market Trends

Nepal’s gold price is primarily influenced by international spot prices. In particular:

- COVID-19 (2020) created a surge in gold investment, pushing prices globally.

- Geopolitical tensions (e.g., US-China relations, Russia-Ukraine war) have kept demand for safe-haven assets high.

- Global inflation and central bank rate cuts boost gold prices.

2. 📉 Nepali Rupee Depreciation

The steady depreciation of the NPR against the USD has made imported gold costlier. Over the decade, NPR/USD moved from ~NPR 100 in 2015 to ~NPR 135+ in 2025, amplifying local price increases even when global gold prices were stable.

3. 📦 Import Restrictions & Duties

- Nepal Rastra Bank (NRB) imposes quotas and taxes to control the outflow of foreign currency.

- Custom duties and VAT (approx. 15–18%) are factored into local gold pricing.

- In years like 2021–2022, tightened import controls led to shortages and price spikes.

4. 🎉 Cultural & Seasonal Demand

Nepal sees spikes in gold demand during:

- Tihar, Teej, wedding seasons, and festivals.

- Gold is considered auspicious and is a traditional investment. Sudden surges in domestic demand impact prices, especially in periods of low import volumes.

📊 Economic Implications

🏦 For the Financial Sector

- Rising gold prices increase the value of gold-backed loans, but reduce volume as fewer can afford to pledge gold.

- Inflation hedge: Many Nepalis invest in gold over real estate or stocks.

📉 For Consumers

- The affordability of gold jewelry has declined.

- Young buyers are shifting toward lighter jewelry and alternative investments.

- Smuggling has seen a rise due to high official prices and import restrictions.

📈 For Government & Economy

- Nepal spends billions in foreign reserves annually on gold imports.

- Government faces challenges in currency management and trade deficit control.

- Increasing gold price is often viewed as a sign of economic instability or global uncertainty.

🗓 Year-wise Highlights

🔹 2020 – Pandemic Gold Rush

- Prices peaked above NPR 95,000 per tola for the first time.

- Investors fled to gold amid global panic.

🔹 2023–2024 – Inflation Hedge Phase

- Prices steadily climbed due to global inflation fears.

- Central banks worldwide started buying gold reserves again.

🔹 2025 – Stabilization or Surge?

- Mid-2025 shows a continued rise (NPR 132,000 per tola).

- If the NPR depreciates further or geopolitical risks rise, gold could hit NPR 140,000+ before year-end.

🔮 Outlook: What’s Next for Gold in Nepal?

- Short-term: Prices will likely remain high, driven by demand and currency weakness.

- Medium-term: If the rupee stabilizes and import volumes increase, prices may moderate.

- Long-term: Global factors like AI-led stock market shifts, digital assets, and energy crises will play a big role.

🧠 Conclusion

Over the last 10 years, gold prices in Nepal have nearly tripled, reflecting both global uncertainties and local economic shifts. For investors and policy makers, understanding this trend is essential not just for forecasting prices, but for evaluating the macroeconomic health of the country. As we move further into 2025, gold will continue to act as a barometer for both public sentiment and market confidence in Nepal.